How much is auto insurance in Massachusetts takes center stage in this comprehensive guide. Delve into the factors influencing rates, average costs, coverage types, discounts, and more.

Explore the intricacies of auto insurance in Massachusetts and gain valuable insights into securing the best coverage for your needs.

Factors influencing auto insurance rates in Massachusetts: How Much Is Auto Insurance In Massachusetts

When it comes to determining auto insurance rates in Massachusetts, several key factors come into play. These factors can significantly impact the cost of your insurance premiums.

Age

Your age is a crucial factor that insurance companies consider when determining your auto insurance rates. Younger drivers, especially those under 25, tend to pay higher premiums due to their lack of driving experience and higher likelihood of being involved in accidents.

Driving Record

Your driving record plays a significant role in determining your insurance rates. If you have a history of accidents or traffic violations, you are considered a higher risk driver and can expect to pay more for insurance coverage.

Type of Vehicle

The type of vehicle you drive also influences your insurance rates. Expensive cars, sports cars, and vehicles with high theft rates typically result in higher premiums. On the other hand, safe and reliable vehicles can lead to lower insurance costs.

Location

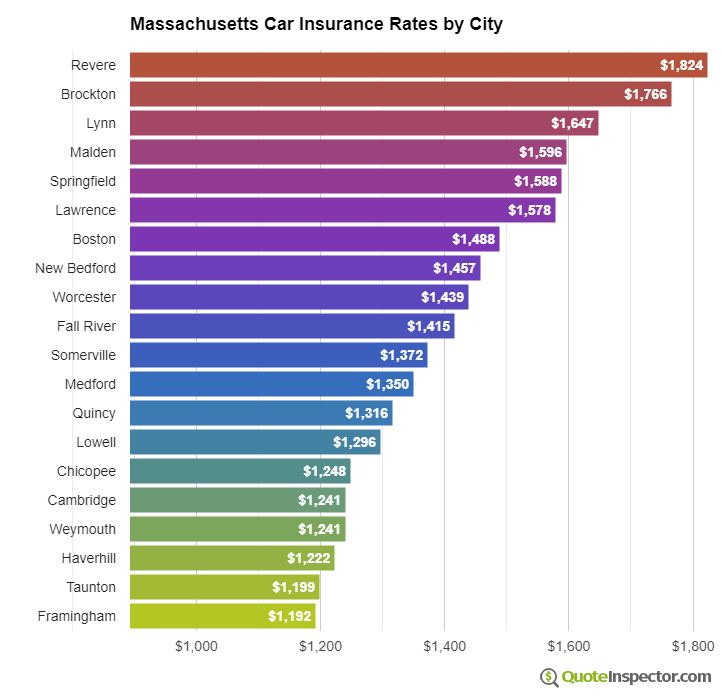

Where you live in Massachusetts can impact your auto insurance rates. Urban areas with higher traffic congestion and crime rates generally have higher premiums compared to rural areas. Additionally, the frequency of accidents and claims in your location can affect your insurance costs.

Average cost of auto insurance in Massachusetts

In Massachusetts, the average annual premium for auto insurance is around $1,460. This places the state on the higher end of the spectrum compared to the national average. The cost of auto insurance in Massachusetts can vary depending on various factors such as age, driving record, type of vehicle, and coverage options.

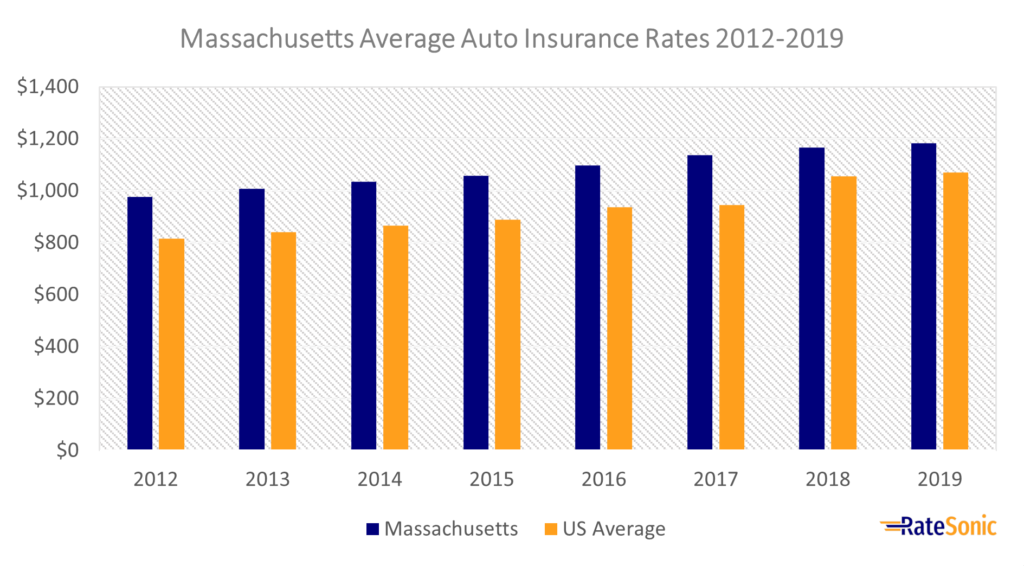

Comparison with National Averages

When compared to the national average annual premium of $1,190, Massachusetts falls above the average. This can be attributed to the higher population density, urban areas, and traffic congestion in the state. Neighboring states like New Hampshire and Vermont have lower average auto insurance premiums due to their rural nature and lower population density.

Trends and Changes in Insurance Rates

Over the past few years, auto insurance rates in Massachusetts have been on the rise. Factors such as increased distracted driving incidents, severe weather events, and rising repair costs for vehicles have contributed to this trend. Additionally, changes in state regulations and insurance laws have also impacted insurance rates in the state. It is essential for drivers in Massachusetts to stay informed about these trends and factors influencing auto insurance rates to make informed decisions when purchasing coverage.

Types of coverage available in Massachusetts

In Massachusetts, auto insurance policies offer various types of coverage to protect policyholders in different situations.

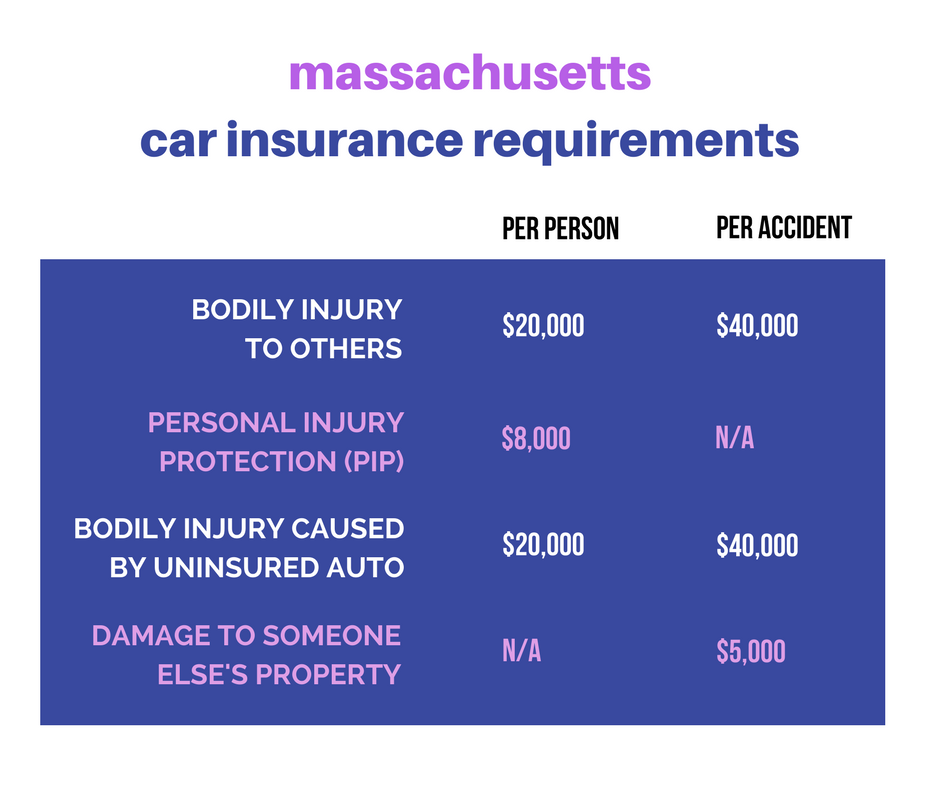

Liability Coverage

- Liability coverage helps pay for injuries and property damage that the policyholder is legally responsible for in an accident.

- It is required in Massachusetts to have a minimum amount of liability coverage to drive legally.

- For example, if the policyholder causes an accident that results in injuries to another driver, liability coverage would help cover the medical expenses of the injured party.

Comprehensive Coverage

- Comprehensive coverage helps pay for damage to the policyholder’s vehicle that is not caused by a collision, such as theft, vandalism, or natural disasters.

- It provides coverage for a wide range of non-collision related incidents.

- For instance, if the policyholder’s car is stolen, comprehensive coverage would help cover the cost of replacing the vehicle.

Collision Coverage

- Collision coverage helps pay for damage to the policyholder’s vehicle in the event of a collision with another vehicle or object.

- It is optional in Massachusetts but can provide valuable protection for the policyholder’s vehicle.

- For example, if the policyholder gets into a car accident with another vehicle, collision coverage would help cover the cost of repairing or replacing the damaged vehicle.

Discounts and ways to save on auto insurance

Insurance companies in Massachusetts offer various discounts to help policyholders save money on their auto insurance premiums. By taking advantage of these discounts and implementing smart strategies, drivers can reduce their insurance costs significantly.

Common Discounts Offered by Insurance Companies, How much is auto insurance in massachusetts

- Multi-policy discount: Save money by bundling your auto insurance with other policies like homeowners or renters insurance.

- Safe driver discount: Get rewarded for maintaining a clean driving record without accidents or traffic violations.

- Good student discount: Students with good grades can qualify for lower insurance rates.

- Low mileage discount: If you don’t drive much, you may be eligible for a discount.

- Affiliation discounts: Some insurers offer discounts to members of certain organizations or professions.

Strategies to Save Money on Auto Insurance Premiums

- Shop around: Compare quotes from multiple insurance companies to find the best rate.

- Inquire about discounts: Ask your insurance agent about all available discounts and how you can qualify for them.

- Consider raising your deductible: A higher deductible can lower your premium, but make sure you can afford the out-of-pocket costs if you need to make a claim.

- Maintain a good credit score: In Massachusetts, insurers can use your credit score to determine your rates, so keep your credit in good shape.

Tips for Maximizing Discounts and Reducing Insurance Costs

- Take a defensive driving course: Completing a defensive driving course can sometimes earn you a discount on your premium.

- Drive a safe vehicle: Safety features on your car can lead to lower insurance rates.

- Review your coverage regularly: Make sure you’re not paying for more coverage than you need, especially if your car is older.

- Bundle your policies: Combining multiple insurance policies with the same company can often result in a discount on each.

Outcome Summary

Discover the nuances of auto insurance in Massachusetts and make informed decisions to protect yourself and your vehicle effectively. Stay informed, stay protected.

FAQ Resource

How do factors like age and driving record influence auto insurance rates in Massachusetts?

Factors like age and driving record play a significant role in determining auto insurance rates in Massachusetts. Younger drivers and those with a history of accidents may face higher premiums.

What is the average cost of auto insurance in Massachusetts compared to national averages?

The average annual premium for auto insurance in Massachusetts typically falls in line with national averages. However, rates can vary based on individual factors.

What are the different types of coverage available in Massachusetts?

Massachusetts offers various coverage options including liability, comprehensive, and collision coverage. Each type provides different levels of protection for policyholders.

Are there specific discounts available for auto insurance in Massachusetts?

Insurance companies in Massachusetts often provide discounts for safe driving, bundling policies, or having certain safety features in your vehicle. Exploring these options can lead to savings on premiums.