Car insurance baldwinsville ny is a crucial aspect of vehicle ownership in Baldwinsville, NY, encompassing various coverage types, cost factors, and provider options. Dive into this comprehensive guide to gain valuable insights and make informed decisions about your car insurance needs.

Overview of Car Insurance in Baldwinsville, NY

Car insurance is essential in Baldwinsville, NY, as it provides financial protection in case of accidents, theft, or damage to your vehicle. It helps cover the costs of repairs, medical expenses, and legal fees that may arise from an unforeseen event on the road.

Types of Car Insurance Coverage

- Liability Coverage: This type of insurance covers injuries and property damage that you may cause to others in an accident.

- Collision Coverage: Helps pay for repairs to your own vehicle after a collision with another vehicle or object.

- Comprehensive Coverage: Protects your vehicle from non-collision incidents like theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Covers your expenses if you are in an accident with a driver who has insufficient or no insurance.

Legal Requirements for Car Insurance

In Baldwinsville, NY, it is mandatory to have a minimum amount of car insurance coverage to legally operate a vehicle. The state requires all drivers to carry at least:

“$25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $10,000 for property damage.”

Failure to maintain this minimum coverage can result in fines, license suspension, or other penalties.

Factors Affecting Car Insurance Rates in Baldwinsville, NY

When it comes to determining car insurance rates in Baldwinsville, NY, insurance companies take into consideration a variety of factors that can influence the cost of coverage for drivers in the area. These factors can range from personal driving history to location-specific demographics, all of which play a role in shaping insurance premiums.

Personal Driving History

- Insurance companies often look at a driver’s personal driving history to assess their risk level. Factors such as past accidents, traffic violations, and claims history can impact car insurance premiums.

- Drivers with a clean driving record are typically considered lower risk and may qualify for lower insurance rates, while those with a history of accidents or violations may face higher premiums.

- It is important for drivers in Baldwinsville, NY, to maintain a safe driving record to potentially lower their car insurance costs.

Role of Location and Local Demographics

- The location where a driver lives can also influence car insurance rates. Urban areas with higher rates of accidents and theft may lead to higher premiums compared to rural areas.

- Local demographics, such as population density, crime rates, and weather conditions, can also impact insurance costs. For example, areas prone to severe weather events may have higher insurance rates due to increased risk of damage to vehicles.

- Insurance companies consider these factors when determining rates to reflect the level of risk associated with insuring drivers in specific locations.

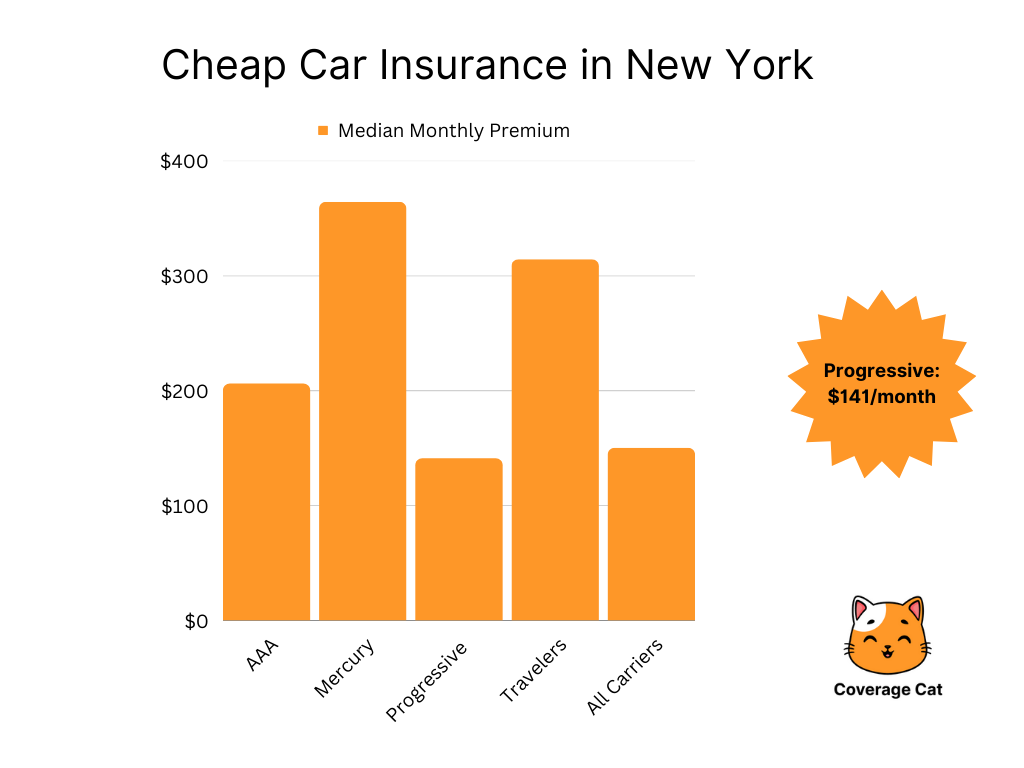

Top Car Insurance Providers in Baldwinsville, NY

When it comes to choosing a car insurance provider in Baldwinsville, NY, there are several options available. Each insurance company offers different coverage options, customer service experiences, and pricing structures. Let’s take a look at some of the top car insurance providers in Baldwinsville, NY and compare their offerings.

State Farm

State Farm is a well-known insurance provider that offers a variety of coverage options including liability, collision, and comprehensive coverage. They are known for their excellent customer service and personalized approach to insurance. State Farm also offers discounts for safe drivers, multi-policy holders, and those with good credit scores.

GEICO

GEICO is another popular choice for car insurance in Baldwinsville, NY. They are known for their competitive pricing and user-friendly online tools for managing policies. GEICO offers a wide range of coverage options including liability, uninsured motorist, and roadside assistance. They also provide discounts for military members, federal employees, and safe drivers.

Allstate

Allstate is a well-established insurance provider that offers customizable coverage options for drivers in Baldwinsville, NY. They provide standard coverage options like liability and comprehensive coverage, as well as additional options like accident forgiveness and new car replacement. Allstate also offers discounts for bundling policies, safe driving, and having anti-theft devices installed in your vehicle.

Progressive

Progressive is known for its innovative approach to car insurance and competitive pricing. They offer a variety of coverage options including liability, collision, and medical payments. Progressive also provides unique features like their Snapshot program, which rewards safe drivers with discounts based on their driving habits. They offer discounts for bundling policies, safe driving, and having multiple vehicles insured with them.

Overall, the top car insurance providers in Baldwinsville, NY offer a range of coverage options, competitive pricing, and discounts to meet the needs of drivers in the area. It’s important to compare quotes and consider factors like coverage, customer service, and discounts when choosing the right insurance provider for your needs.

Tips for Saving Money on Car Insurance in Baldwinsville, NY

When it comes to car insurance in Baldwinsville, NY, there are ways to save money without compromising on coverage. By being proactive and strategic, you can reduce your car insurance costs and find the best deal for your needs.

It’s important to shop around and compare quotes from different insurance companies in Baldwinsville, NY. Rates can vary significantly between providers, so taking the time to research and compare options can help you find the most affordable policy that meets your requirements.

Consider Bundling Policies

If you have multiple insurance needs, such as home or renter’s insurance, consider bundling your policies with the same insurance provider. Many companies offer discounts for bundling, which can result in significant savings on your overall insurance costs.

Take Advantage of Discounts

Insurance companies in Baldwinsville, NY often offer various discounts that can help you save money on your car insurance premiums. These discounts may be based on factors such as good driving records, safety features in your vehicle, or even completing a defensive driving course. Make sure to inquire about available discounts and see if you qualify for any that can help lower your insurance costs.

Drive Safely and Maintain a Good Credit Score, Car insurance baldwinsville ny

Maintaining a clean driving record and a good credit score can also help you save money on car insurance in Baldwinsville, NY. Safe drivers and individuals with good credit are often viewed as lower risk by insurance companies, which can result in lower premiums. By practicing safe driving habits and being financially responsible, you can potentially reduce your insurance costs over time.

Wrap-Up

In conclusion, navigating the realm of car insurance in Baldwinsville, NY requires understanding the coverage essentials, cost determinants, and available options. By applying the tips and insights shared in this guide, you can secure optimal protection for your vehicle while maximizing cost savings.

Query Resolution: Car Insurance Baldwinsville Ny

What are the legal requirements for car insurance in Baldwinsville, NY?

In Baldwinsville, NY, drivers must have liability insurance coverage to legally operate a vehicle on the road.

How can personal driving history impact car insurance premiums in Baldwinsville, NY?

Insurance companies often consider factors like accidents, violations, and claims history when determining premiums based on personal driving records.

What are some effective strategies for reducing car insurance costs in Baldwinsville, NY?

To save money on car insurance, residents of Baldwinsville, NY can explore options like bundling policies, comparing quotes from different providers, and taking advantage of available discounts.